State of the Market2020 Chairman's Report

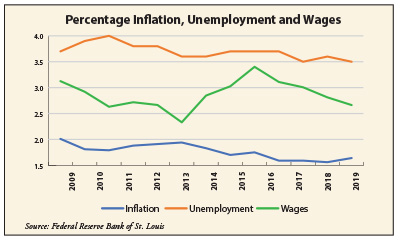

Despite some initial uncertainty, 2019 rose to the occasion and proved to be yet another good year for the economy and our real estate market. The trends that kept our economy growing for the past several years continued to be positive. Unemployment remained low, inflation was muted, job growth was strong, and wages continue to grow.

Opening doors to life's most meaningful dreams

The question on everyone’s mind is: How long will this continue? There is no reason to think these favorable conditions won’t continue through or into 2020. Yes, there has been talk of the inevitability of a recession, perhaps just around the corner, but so far, the Federal Reserve’s monetary policy has kept the economy growing and investors are positive about the future. The fact that 2020 is a presidential election year is another good indication that bodes well for the economy. hen the economy is good, incumbents tend to get re-elected. Our current administration will use all of its power to ensure that the economy won’t slow down this year. Even if we were to go into a recession sometime this year, it will be mild. Moody’s Analytics Chief Economist Mark Zandi expects that when we finally do enter a recession, it will only last about a year. Why? Unlike previous recessions where there were bubbles to burst, there is no current major imbalance in our present economy. Of course, there is always the caveat that an unexpected geo-political event could move us into a recession sooner. Just as the economy was steady last year, so was our local real estate market. The number of homes sold in 2019 was just slightly higher than in 2018. But the number of houses for sale decreased almost 12% over the same time period, further contributing to the shortage of housing inventory for sale. Days on market also held steady, rising only 2% to an average of 50 days. Home values rose 7% in the City of Philadelphia and just over 3% in the southeastern Pennsylvania suburbs. (Federal Home Finance Agency HPI.) Like the economy, the real estate market will do well in 2020. We anticipate that the number of houses sold will remain steady or increase up to 2%. Inventory will follow last year’s trend and may drop even more in many price ranges, so we expect average sales price to increase 3-4%. The Tale of Two Markets remains: Even though Months Supply of Inventory (MSI) dropped 25% last year in the $1 million+ price range, there is still an oversupply with a SI of 11 months. MSI in the lower price ranges is only 2.8 months.

This year, the Federal Home Finance Agency (FHFA) Mortgage rates remain at historic lows and are currently Throughout 2019, I said that it was a great time to sell or Why it’s a great time to sell Unless your house is in the high-end price range, where inventory is not constrained, this unprecedented lack of inventory gives sellers an advantage. If your house is priced right and shows well, don’t be surprised if you get multiple offers. But your house has to be up-to-date and in excellent condition. Back when Baby Boomers were purchasing their first or second home, they could see its potential and were willing to do the desired renovations. Not so for Gen Y. They are not interested in buying a home improvement project. If you are thinking about selling to take advantage of the market, your BHHS Fox & Roach sales associate will advise you how to make your house

look its absolute best. And, when offers come in, they’ll be there to help you determine which one to accept. Why it’s a great time to buy Right now, affordability is high and the combination of modest price increases and low mortgage rates allows buyers to get the most house for their money. As inventory decreases, prices will rise even more. And mortgage rates are at historic lows. At some point, the economy will gather more steam, causing interest rates to rise. When that happens, buying a home will become more expensive. You also need to be prepared: Educate yourself about the real estate market so you will know which houses are priced well. You must also be pre-approved (not pre-qualified) for a mortgage. It’s likely you may be competing with other offers, and a pre-approval will prompt sellers to seriously consider yours. Your Trident mortgage consultant will work with you to better understand just how much home you can afford, and start the pre-approval process. We’ve opened the door to a new year. The door to the best opportunity may swing slowly or slam shut, and the truth is we never really know when the “best time” was, until after it has happened. Will this be the year you open the door to a new home? Gather your resources and all of the information you can, so that when you see your dream home, you’ll be ready. Wishing you all the best for the New Year!

Lawrence F. Flick, IV

National Economic Outlook: After several quarters of strong gains, growth moderated beginning in the spring of 2019. A number of factors contributed to the slowdown. As expected, the effects of the tax cuts faded. Going forward, the expansion will have to be driven by economic fundamentals, not tax policy. The tight labor markets restrained the ability of firms to expand, even when growing demand required them to do so. Finally, and maybe most importantly, the tariffs and trade war with China reduced business confidence and increased uncertainty, reducing business capital spending. In contrast, consumers continued to spend money solidly, sustaining the expansion at a decent, though not spectacular pace. In addition, government spending ramped up, adding to the expansion. Looking toward 2020, there are some risks to growth. Though still solid, wage gains are moderating. Also, mounting debt, though still not excessive, could start impinging on consumer spending. Household spending should remain solid in 2020, but may not be nearly as robust as it had been. While progress is being made on a first phase trade agreement with China, the problems created by contentious negotiations continue to overhang the economy. There is a lot more to be done before peace returns to the relationship between China and the U.S. and as long as tariffs and a trade war overhang the economy, growth is not likely to return to strong levels. The outlook is for the national economy to continue expanding at a roughly 2% pace in 2020, slightly down from the projected 2.25% 2019 rate. The one big caveat is that the trade situation doesn’t worsen. While that is not expected, a full-fledged trade war could slow growth to the extent that a recession could not be ruled out. Interest Rates and the Housing Market: The Federal Reserve aggressively reduced short-term rates during 2019 but has signaled that it has done enough. It will take a significant change in the path of the economy to get the Fed to either lower rates further or even raise rates. Barring a trade war, the Fed could be on hold for much, if not all, of 2020. Again, assuming no major trade battles, longer-term rates would react to the more stable outlook by slowly rising. Nevertheless, over the next year, there is little reason to expect a surge in rates from their current low levels. The low mortgage rates have supported the housing market, but the gains have been surprisingly modest. Housing starts, permits and sales are improving, but not surging. Home prices, after decelerating fairly sharply for most of the year, have recently begun to rise faster again. The impediment is supply, which remains low across most of the nation. Thus, even the more moderate economic growth expected could cause prices to continue increasing at a decent pace. The outlook is for housing sales to remain on its modest upward path while prices reaccelerate slightly. Regional Economy and Housing: The greater BHHS Fox & Roach region continues

to grow at a decent pace. Job gains in the region are solid, running only slightly below The housing market was good, but did show some signs of moderation. Sales were largely flat in many areas and price gains, though solid, started to decelerate during the year. But as typically is the case, that was not true throughout the market area. This mirrors the national pattern, which indicates the region’s housing market is tracking the nation more closely than in the past. The rising prices, when coupled with the lack of supply, are making it difficult for home sales to accelerate. The outlook is for the region’s economy to equal if not outperform the nation and

that should lead to continued improvement in housing sales and prices. The area is City of Philadelphia: The City of Philadelphia continues to expand at the strongest

pace in the market and it is even outperforming the nation, as job gains have been Philadelphia’s problem may be its success. Housing prices and commercial rents are

increasing at a pace that has started to slow the respective markets. Sales gains are Pennsylvania Suburbs: With costs rising in the city, the Montgomery-Bucks-Chester

area has started reaping the benefits. Job gains are good and are approaching national

© BHH Affiliates, LLC. An independently operated subsidiary of HomeServices of America, Inc., a Berkshire Hathaway affiliate, and a franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway |

Joel L. Naroff is the President and founder of Naroff

Economic Advisors, a strategic economic consulting

firm. He is the author of Big Picture Economics,

which has been translated into Chinese. Joel has won

numerous forecasting awards, is often quoted in the

national and international press, and is a newspaper

columnist and radio commentator.

Joel L. Naroff is the President and founder of Naroff

Economic Advisors, a strategic economic consulting

firm. He is the author of Big Picture Economics,

which has been translated into Chinese. Joel has won

numerous forecasting awards, is often quoted in the

national and international press, and is a newspaper

columnist and radio commentator.